Curve has inverted before each recession in the past 50 years.

Does inverted yield curve mean recession.

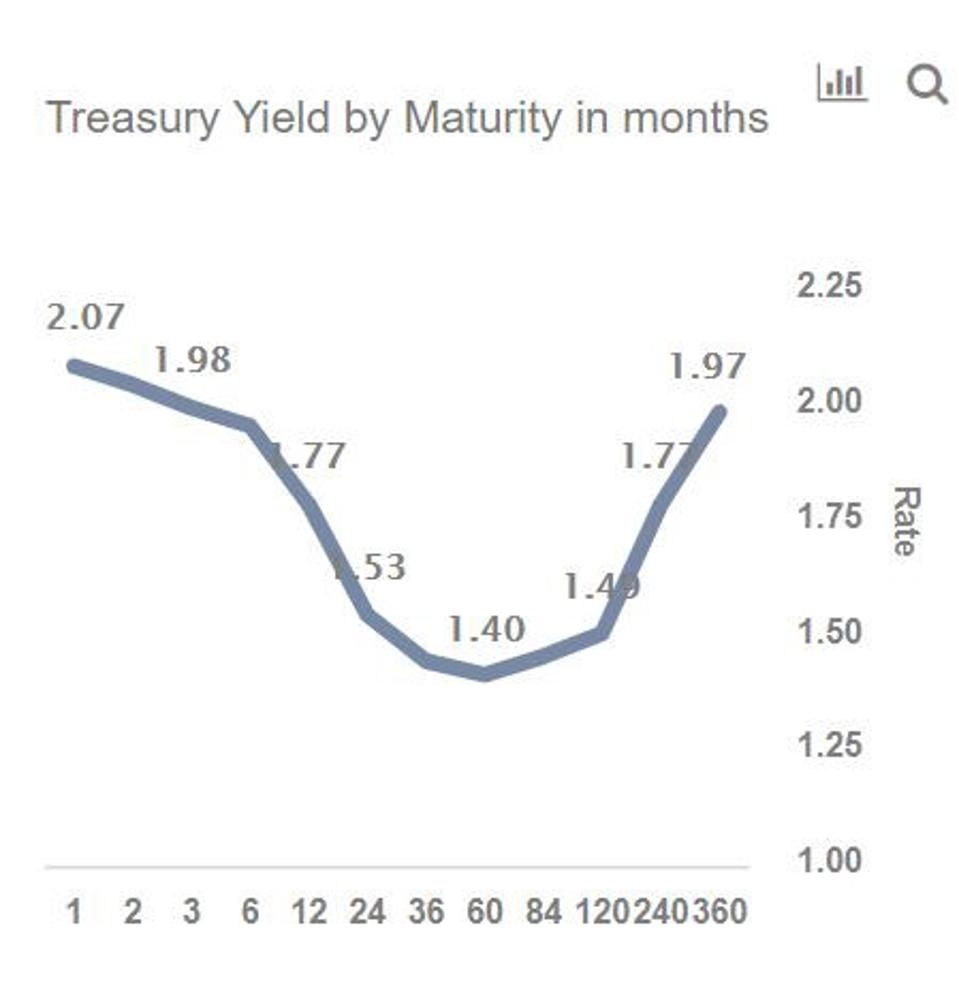

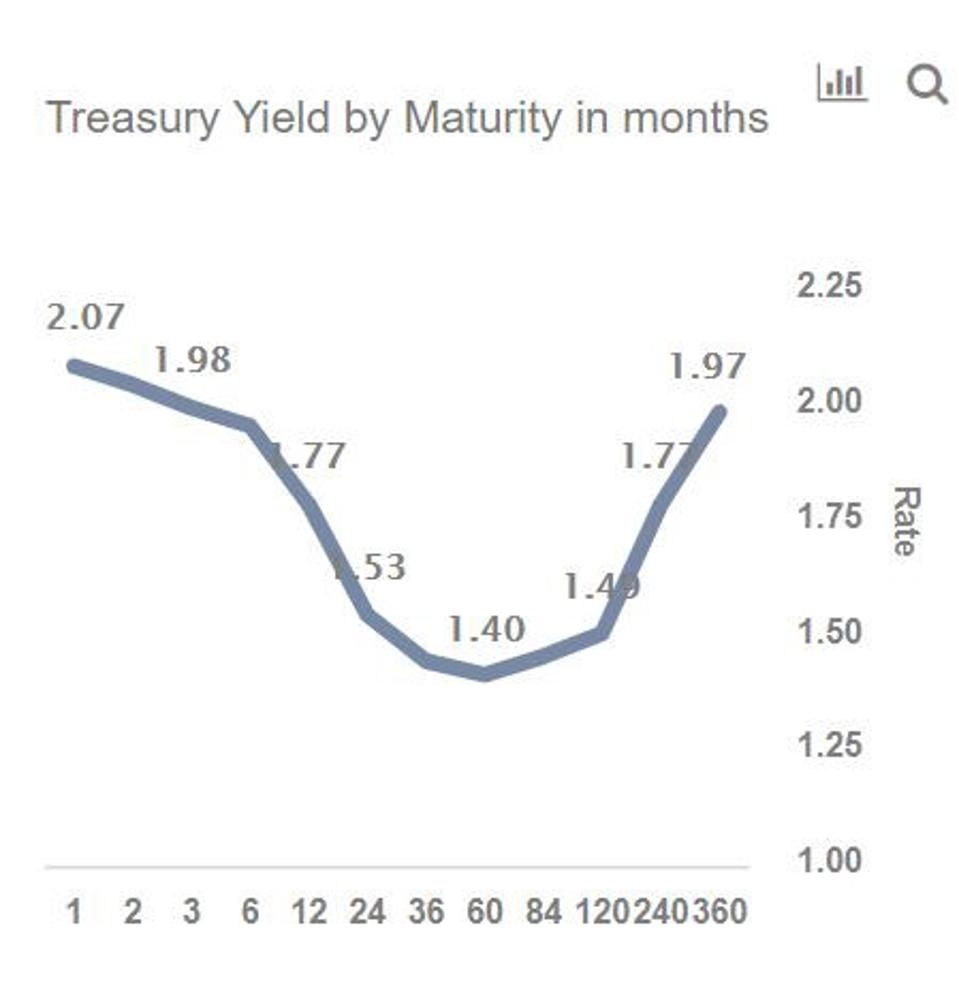

An inverted yield curve is an interest rate environment in which long term debt instruments have a lower yield than short term debt instruments of the same credit quality.

When the inverted yield curve last forecast a recession the treasury yield curve inverted before the recessions of 1970 1973 1980 1991 and 2001.

What does a yield curve inversion mean and what might it indicate for the u s.

This hasn t happened.

Inverted yield curves in the us and elsewhere tell us very little about the timing of future downturns and for now at least the economic data are more consistent with a slowdown than a downturn.

Let s take a look at the history of the connection between recession and yield curve inversion to help us.

Inverted yield curves are an essential element of these cycles preceding every recession since 1956.

Because of that link substantial and long lasting.

It offered a false signal just once in that time.

The yield curve also predicted the 2008 financial crisis two years earlier.

Yield curve inversion is a classic signal of a looming recession.

An inverted yield curve for us treasury bonds is among the most consistent recession indicators.

While the yield curve has been inverted in a general sense for some time for a brief moment the yield of the 10 year treasury dipped below the yield of the 2 year treasury.

Considering the consistency of this pattern an inverted yield will likely form again if the.